Best Small-Business Bookkeeping and Accounting

Why QuickBooks Online?

For example, compare sales to expenses to get a general idea of how your company has fared recently. Obviously, if sales are higher than expenses, you are making a profit. For more complex reports, turn to an accountant or accounting program.[13]For more information on posting to a ledger and creating simple reports, see how to write an accounting ledger. Decide on which method to use.

The QuickBooks Self-Employed plan, limited to one user, comes in at $15 per month and works best for freelancers and sole proprietors. You can manage invoices; accept credit and debit card payments; track miles, income, and expenses; and run financial reports. With any of FreshBooks’ pricing plans, you can send an unlimited number of invoices and estimates to your customers, accept credit card payments online, track time and expenses, and automatically sync with your bank account to get expense updates. FreshBooks’ cloud-based software comes with time-saving features for small-business owners. It nabbed the top spot in our book for one-person startups and customers who need only invoicing capabilities rather than a complete accounting software solution.

Bookkeeper rates vary depending on the business size, industry, and financial services needed. In-house bookkeepers can charge anywhere from $18-23 per hour, with variations depending on experience. Outsourced bookkeepers can be another solution with monthly bookkeeping fees starting from $99 per month. Businesses that have been in operation longer, manage more employees, or are growth-driven may require more robust bookkeeping services.

Bank feeds link up your accounting software with your business bank account, allowing you to see each transaction in real time. QuickBooks is an accounting software used broadly by small businesses. QuickBooks is used for everything from running payroll to tracking income and expenses to putting together financial reporting packages and more. Plus, QuickBooks automates time-consuming processes, like preparing bank reconciliations, and you don’t have to be an accountant or bookkeeper to use it. This iteration is called Sage Business Cloud Accounting Start, designed for both sole traders and cash-based businesses.

What if you input your revenue wrong? Without a pro taking a look at your work, there’s a big chance your mistake will go unnoticed. Depending on the way you’ve structured your business legally, you’ll have different tax consequences.

If a customer pays you a sum, you enter that sum in your asset column only. Makes sense, right? This method can work if your business is simple—as in, very, very simple.

You can also dip into here to adjust customer and supplier opening balances as well as bank and nominal opening balances. You can also change, among many other things, business details, invoice and quote settings. Thank you for your feedback Roman! I agree with you 100% that finding the right accounting software can be a big pain point for a small business.

Sage One vs QuickBooks Online vs Xero

- Since you’ll have a separate business account, use it to track every expense with receipts and a dedicated business debit card.

- If your bank account is unsupported, you can manually upload statements.

- You do not have to be an accountant or bookkeeper to learn how to use QuickBooks.

- This one throws in another variable – what the bookkeeper has to do when sales tax is involved.

- Shoeboxed syncs with many of the top accounting software we recommended here, including QuickBooks, Wave, and Xero.

- As a result, it’s only £10 a month (although the company offers a one-month promotional rate for new customers at just £5 a month) and although it’s a slimmed-down version of Sage’s other packages, it allows for simple tracking of income and expenses, invoicing, real-time reporting, integration with your bank account and VAT returns.

If you are hiring staff and anticipate a lot of growth, you may hire a controller to handle your financial management and accounting. If your business is going to grow but you anticipate https://www.bookstime.com/ slow growth, you may simply hire an accountant or bookkeeper to handle the accounting system. Bookkeeping in a business firm is the basis of the firm’s accounting system.

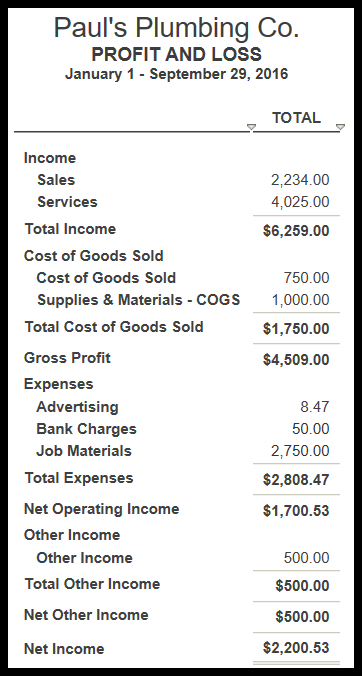

Your total assets should equal the sum of all liabilities and equity accounts. The balance sheet provides a look at the current health of your business and whether it has the ability to expand or needs to reserve cash.Profit and loss (P&L) statement. Also called an income statement, this report breaks down business revenues, costs, and expenses over a period of time (e.g., quarter). The P&L helps you compare your sales and expenses and make forecasts.Cash flow statement.

Sending prospective customers to voicemail when they need your services right then and there can cost you new business when things slow down. Go Answer is a bilingual answering accounting profit service that connects your customers to live customer service agents via phone, text, web chat, or email 24/7. You can get started today with a 30-day free trial.

Income statement accounts are operating and nonoperating revenues, expenses, gains and losses. Your company might require accounts for specific customers, departments or products. Your small business might prefer to use only a few accounts.

It has a user-friendly interface and simple terminology that make it easy to navigate and use. Get up to speed quickly with our FREE QuickBooks https://www.bookstime.com/articles/opening-entry Online training tutorials. QuickBooks Self-Employed is the ideal product for freelancers, real estate agents and Uber/Lyft drivers.

Thanks for visiting the site! I recommend taking a look at Quickbooks Online.

The controller is responsible for financial and managerial accounting; in other words, responding to the firm’s accounting data in an appropriate and responsible manner. A controller is usually hired as a business gets larger. Where the bookkeeper records and classifies the financial transactions of the company, the accountant takes the next steps and analyzes, reviews, reports, and interprets financial information for the company.

Companies likeQuickbooksprovide robust software that can help facilitate advanced accounting functions. Not only are many of these types of tools extremely helpful, they can also save money when it comes to hiring a traditional accountant. Although this is a great option foraccountants, it may not be optimal for business owners.

With the software all ready to go, you can tackle double-entry bookkeeping with no sweat. However, most bookkeeping is done using the double-entry accounting system, which is sort of like Newton’s Third Law of Motion, but for finances. Newton’s law holds that “for every action (in nature), there is an equal and opposite reaction.” Likewise, in double-entry accounting, any transaction in one account requires an equal and opposite entry in another account.